New Delhi: India faces a myriad of critical challenges spanning across these domains –worsening Air Quality Index (AQI), burgeoning greenhouse gas (GHG) emissions, persistent traffic congestion, and regrettably, one of the highest road accident rates globally.

It is important to note that with the highest PM2.5 emissions in the world, India is home to 14 cities that prominently feature in the list of the 20 most polluted cities on the planet, contributing to a staggering loss of 1.2 million lives annually due to pollution-related causes. Furthermore, 12% of the country’s total GHG emissions emanate from road transportation.

An average Indian residing in a metropolitan area spends ~200-250 hours per year stuck in traffic during peak hours, which is a colossal drain on the overall productive capacity and quality of life. India also contributes to 10% of the total number of global road accidents, amounting to a fatality rate of 34.5% with more than 150K lives being lost every year.

One of the countries that has made huge strides in improving upon these aspects is Japan wherein efforts directed towards the decarbonisation of the transportation sector, as well as the measures taken to ensure road safety and mitigate traffic congestion have helped bring about substantial improvements on these parameters.

Additionally, they have been able to maintain the value add of the automotive industry and it continues to be a major driver of the economy and employment.

Through this article, we also seek to derive key insights and learnings that India can glean from Japan’s exemplary trajectory in its pursuit of sustainable mobility.

Learnings from Japan on decarbonisation

Japan stands as a prominent example for its efforts to decarbonize its national economy. They have achieved reductions in automotive emissions (29%) and crude oil imports (49%) over the last two decades despite achieving 1.5X growth in the vehicle parc and have seen a significant increase in automotive sector revenues of 17%.

There are two themes underlining this commendable achievement:

1.Better should not become the enemy of the good

Japan has consistently maintained a multi-technological outlook and has proactively implemented policy interventions to invest in and develop expertise in emerging technologies. This strategic approach has been instrumental in propelling the growth of the Japanese automotive industry across four significant time frames:

i) National Electric Vehicle Project (1971-1977): “Thinking for the future”- The project received a funding of USD 39.2 million, with focus on R&D efforts in EV battery, motors and chassis manufacturing, leading to the development of prototypes of EVs along with battery chemistries.

ii) Clean Energy Vehicle Introduction Project (1998-2005): “Solving for the immediate needs and establishing technology prowess”- This era focused on incentivising cleaner vehicles, covering up to 50% of the additional cost, and tax incentives for the purchase of Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), Compressed Natural Gas (CNG) vehicles, and methanol-powered vehicles.

iii) Eco-Car Tax Break (2009-2021): “Building on strengths – 26% Crude Import Reduction in last decade” – In this decade, Japan focussed on building on its strengths, thus further pushing the adoption of cleaner vehicles. To further support the adoption of CEVs, initiatives such as the Flex Fuel Program (2010) and Corporate Average Fuel Economy (CAFE) mandates (2015) were introduced. HEV sales penetration reached ~39% in 2021.

iv) Clean Energy Vehicle Subsidy (2021-Present): “Driving towards Net Zero”- Currently, the government is continuing its push for adoption of CEVs through tax breaks and purchase assistance for BEVs, PHEVs, FCEVs. Carbon based taxation continues to incentivise HEVs over conventional vehicles.

2.Ensuring industry competitiveness

In its quest for decarbonisation, Japan has built the foundation of competitiveness of the automotive industry through cutting edge innovation and localisation of the technology. They have actively invested in new technology, materials, and manufacturing processes across the value chain while ensuring that the value add stays in the country and contributes to economic growth and development.

i) Investing in cutting edge technologies: Japan has always been a leader in the realm of technological innovation, exemplified by their early foray into electric vehicle development, which commenced from1971. This move has culminated in Japan currently holding a formidable 20% share of the global Lithium-ion Battery (LiB) equipment manufacturing market. Among the top five companies worldwide in this sector, two are of Japanese origin—CKD and Daiichi Jitsugyo. Notably, Panasonic, ranking as the fourth-largest global battery manufacturer, commands a market share of ~7.3%.

Furthermore, Japan has demonstrated pioneering expertise in the field of electric vehicle and Hybrid Electric Vehicle (HEV) technology. Honda and Daido Steel, both hailing from Japan, have achieved breakthroughs by developing the first rare-earth-free magnets designed specifically for EVs and HEVs.

Similarly, in the domain of battery chemistries, Toshiba has engineered advanced Super Charge Ion Batteries (SCiB) featuring Lithium Titanium Oxide (LTO) based anodes, showcasing Japan’s prowess in cutting-edge energy storage technologies. Moreover, the Japanese government has made a strategic revision to the country’s semiconductor sales target, setting an ambitious goal of reaching USD 108 billion by 2030. This move aligns with their proactive efforts to re-establish a strong foothold in the semiconductor market, further underscoring Japan’s commitment to technological advancement.

ii) Building on Strengths: Japan is known for supplying exceptionally fuel-efficient vehicles to the global market. Under pursuit of continuous improvement, Japan periodically revises its fuel efficiency standards across various powertrain technologies. The most recent revision, reflects a substantial increase of ~32.4% from the benchmarks established in 2016 for fuel efficiency target for passenger vehicles (PVs) by the year 2030.

Nissan was a pioneer in introducing an innovative adhesive bonding technique, which involves the joining of two surfaces to create a strong bond. This technique supplants the traditional method of spot welding for enhancing rigidity while simultaneously achieving light-weighting goals, which will help OEMs to meet the required efficiency standards and help in decarbonisation efforts. Aiding the adoption of zero emission vehicles, continuous advancements are being made to integrate Battery Energy Storage System (BESS) technology with charging infrastructure, thereby enabling the commercial viability of ultrafast chargers with grid resilience.

Toshiba’s technology will help in setting up decentralized hydrogen production centres, offering solutions for energy storage, backup power, and grid support while contributing to sustainability and reduced carbon emissions.

On the vehicle component manufacturing front, Giga casting technology to construct select car body parts from two or three main components, is in development which can potentially replace 70 parts with two to three huge castings. This transformative approach will streamline manufacturing processes and significantly reduce associated costs.

iii) Leveraging Keiretsu: Keiretsu, characterized as an interconnected consortium of companies composed of manufacturers, distributors, supply chain partners, and financing entities, significantly influence the localization of value addition, particularly with regard to new technologies originating within Japan. These consortiums have played a pivotal role in fostering the establishment of robust supplier ecosystems. For instance, the presence of tool and die industry clusters serves as a critical component of the outsourcing ecosystem, facilitating the efficient and collaborative development of components and parts.

Additionally, Industry players like component manufacturers, supply chain partners, distributors regularly organise exhibitions on latest technologies like Light-weighting, providing a platform for the exchange of insights and expertise among various stakeholders in the ecosystem, thereby fostering collaborative growth and advancement.

iv) Ensuring competitiveness through Mother Industries: Japan has exhibited incredible strength in the developing industries closely associated with the automotive sector, often referred to as the mother industries. A case in point is Japan’s tool and die manufacturing sector, where it ranks as the world’s fourth-largest producer, with a substantial market share of ~13%, equating to USD 8.9 billion in production value.

Moreover, Japan has a commanding position in the global industrial robotics market, manufacturing ~45% of all industrial robots worldwide. Prominent Japanese companies such as Kawasaki, Fanuc, Yaskawa, Daifuku, and SMC are key players in this sector, contributing to Japan’s leadership in advanced automation and robotics technologies.

v) Export led growth: Japan automotive industry’s growth receives additional impetus from its surplus production capacity. The country is the 2nd largest exporter of automobiles globally. By the year 2018, the country accounted for ~9% of the total CEV exports globally. Nissan LEAF, one of the globally best-selling EV, serves as a testament to their prowess in automotive innovation.

Learnings from Japan on road safety

Japan has demonstrated pioneering leadership in road safety technologies too, notably with the introduction of the intelligent transport system (ITS) in 1973. Japan achieved a remarkable reduction in road accident fatalities, plummeting from over 16,000 in 1970 to fewer than 3,000 in 2022 through concerted policy efforts to introduce strict enforcement measures, and comprehensive road safety education programs targeting children, and technology advancements.

1. Enforcement

In 1970, the Japanese government enacted the Traffic Safety Policies Basic Act. This legislation has been subject to periodic revisions, occurring at intervals of five to ten years, wherein targets and objectives for future are established.

2. Education

Courses on road safety have been mandated to be included in academic curriculum for school children. Additionally, 100+ dedicated traffic parks have been set up across the major cities in the country to simulate real time traffic and reinforce academic learning. Cultivating the right attitude towards road safety from an early age among children has been pivotal in reducing the number of fatalities.

3. Engineering

Despite a high vehicle density, Japan has effectively addressed road congestion within its cities, which can be attributed to development of technological solutions like Vehicle Information and Communication System (1996), Fast Emergency Vehicle Preemption System (2001), Electronic Toll Collection (2001), Driving Safety Support System (2006), Traffic Signal Prediction System (2016), Mobility as a Service (2019), Advanced Pedestrian Information Communication System (2020).

Takeaways for India

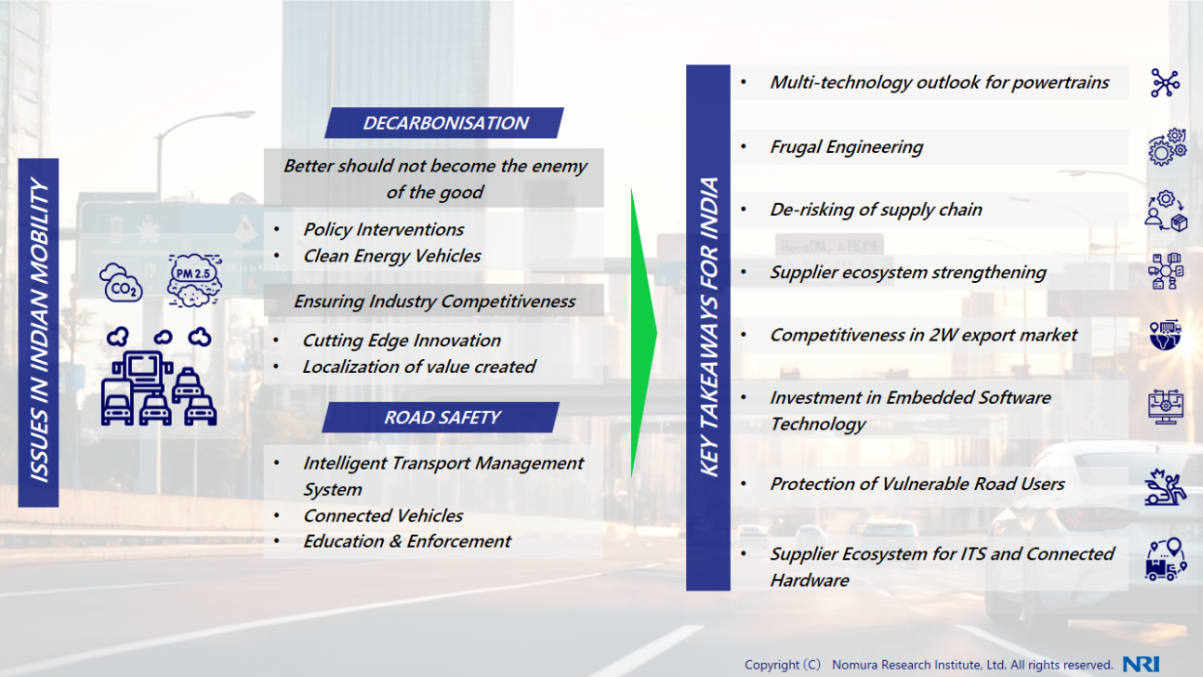

Sustainable Mobility for India could hinge on three key pillars for ensuring clean, safe and economically beneficial mobility for India.

1. Not letting better become the enemy of good

India should identify which are the ‘good enough’ or ‘low hanging fruits’ in the industry to bring out immediate benefits to emissions reduction and crude oil import reduction while focussing on net zero achievements in the long run. A multi-technology powertrain outlook should be maintained consisting of Battery EVs, Hybrids, Natural Gas and Hydrogen. The adoption of Natural Gas Vehicles (NGVs) will complement electrification efforts in the PV, 3W, and LCV segments, potentially generating USD 120 billion in foreign exchange savings by 2030. Concurrently, leveraging Ethanol for the substantial non-electrified fleet in the 2W and PV segments could result in USD ~24 billion in oil import savings by 2030. H2ICE shall provide an effective pathway for decarbonisation of the heavy trucking segment.

2. Building Industry competitiveness

The industry must prioritize retaining ‘value add’, within the country while embracing decarbonisation and focusing on frugal engineering. This involves developing electrodes and cell level competence leading to new battery chemistries tailored to the Indian vehicle price points and usage conditions in order to fulfil the projected advanced chemistry cell battery demand of ~200-250 GWH by 2030. Investing in locally developed alternative technologies like rare earth-free motors can enhance xEV supply chain stability.

Cultivating a robust Tier 2 supplier ecosystem, including tool & die manufacturers, and tapping into the extensive network of MSMEs are crucial for localizing production and development of the auto component industry in the country.

Furthermore, capitalizing on India’s dominance in 2W & 3W vehicles and innovative business models such as battery swapping opens doors for exports to regions like Africa, SAARC, South East Asia, and Latin America, which have favourable usage patterns for uptake (One million E2W sales opportunity in Africa by 2030).

3. Ensuring safer roads for all

India can plan for rapid adoption of Intelligent Traffic Management Systems to reduce congestion, drive enforcement and remove black spots on the roads. These initiatives, apart from ensuring road safety through enforcement and education, will also potentially create a business opportunity worth USD 2.8 billion by 2028.

(Disclaimer: Ashim Sharma is Senior Partner and Group Head Business Performance Improvement Consulting (Auto , Engineering and Logistics), NRI Consulting & Solutions India. Views are personal)