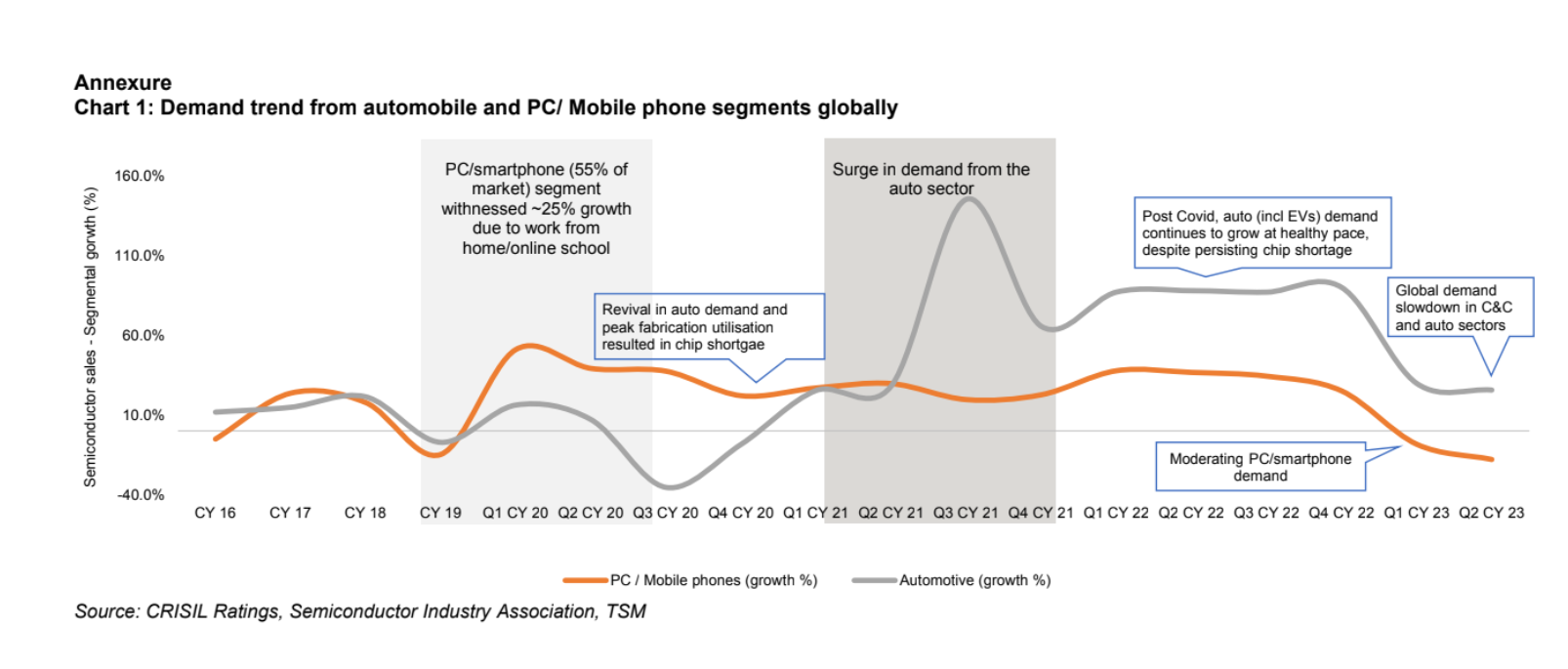

New Delhi: The global shortage of semiconductors, or chips, which had hobbled automobile production and sales in India since 2020-21 is easing after improved supplies from better production schedules enabled by predictive demand forecast. Demand-supply dynamics are expected to be more balanced by fiscal 2026 when additional global manufacturing capacities are set to become operational.

Computer and communication equipment (C&C) segment consumes ~63% of chips produced, followed by automobiles ~13%, and consumer and industrial segments ~12%.

Passenger vehicles (PVs) consume ~1,500 chips on average, the highest among all automobile types. The chip requirement increases as more advanced electronic features are incorporated. Electric PVs use almost twice as many chips as internal combustion engine (ICE) PVs. New orders to be serviced remain high at ~700,000 at the end of September 2023, despite chip availability easing considerably.

Lately, improving supply and slowing demand for computers and mobile phones have led to reallocation of chip supplies for other segments, particularly automobiles.

Earlier, global automobile demand, severely impacted by the Covid-19 pandemic, made a strong recovery in the latter part of fiscal 2022. But the automobile manufacturers were caught off guard by the short supply of semiconductors as they had not placed adequate orders for them.

Given the criticality of chips in the defence and aerospace industries, the United States and the European Union have offered incentives of USD 100 billion for localisation of semiconductor fabs. As a result, many global players are slated to spend ~USD 360 billion towards setting up new facilities, which are set to become operational by fiscal 2026. This will then ensure more balanced chip supply across countries.

In the Indian context, demand for chips will continue to increase over the medium term, driven by the gradual rise in EV adoption and growing demand for advanced feature-laden ICE vehicles.

Anuj Sethi, Senior Director, CRISIL Ratings, said, “The chip shortage faced by Indian passenger vehicle makers is easing, with current availability at 85%-90% of total requirement. The production loss on account of chip shortage, which had halved to ~300,000 PVs on-year in fiscal 2023, is estimated to have further declined to under 200,000 PVs by the end of September 2023.”

Naren Kartic K, Associate Director, CRISIL Ratings, said, “India currently meets its chip demand through imports. The government has allocated ~USD 10 billion for development of the semiconductor ecosystem in a bid to cater to rising demand and reduce import dependence. This includes offering incentives of up to 50% of the project cost to support establishment of foundries. That said, given India’s nascence in the field, successful joint ventures with established global players and commissioning of facilities will be crucial.”