US-based deep tech venture capital investment firm said that it would double down its spend on India’s startups that could create products for markets worldwide, and expects a healthy return opportunity.

“We invest 10% to 15% in India today, and expect that to grow. In fact, we are doubling down on doing more things in India. Because we think that there is an incredible opportunity for return on capital, from companies (deep tech) that can grow,” Sriram Viswanathan, founding managing partner, Celesta Capital LLC, told ETTelecom.

Further, the venture capitalist said that the firm invests in early stage startups. “We are not only investing in deep tech companies that can target India, but are also looking at companies that can create products and technologies in deep tech that can be applicable globally, for global adoption.”

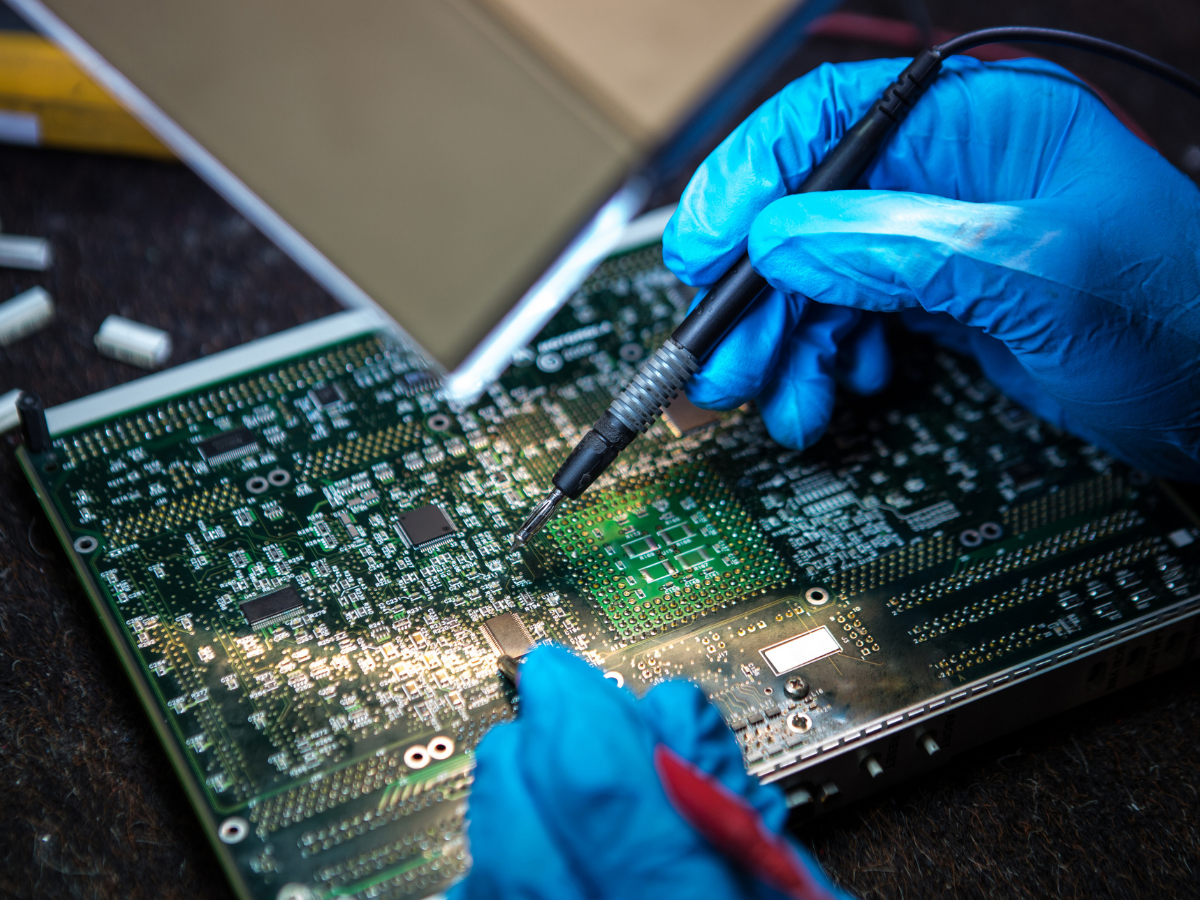

Deep tech or hard tech are engineering-led innovative startups across artificial intelligence (AI), machine learning (ML), quantum computing, blockchain, robotics and semiconductors areas, and have lately caught fancy among investors. It has a potential to bring disruption or create niche markets.

“It (deep tech) presents an incredible opportunity for India, to increase its value add in the global technology development. India should actually take advantage of its skilled labour force and continue to improve it to be able to solve some of the more difficult problems that the world has, such as finding an alternate semiconductor manufacturing capability or advanced semiconductor design or AI, or software development, and any of these areas could become a natural transition for India to evolve to,” Viswanathan said.

Established in 2013, Celesta’s founding partners include technology industry veterans Michael Marks, Nicholas Brathwaite, Sriram Viswanathan, and Lip-Bu Tan.

San Francisco-based VC firm invested in Mumbai-headquartered ideaForge that designs and manufactures drones for mapping, security, and surveillance applications, which launched an initial public offering (IPO) early this year.

Celesta also invested in startups such as Chennai-based space startup Agnikul, and Bengaluru-located Tonbo Imaging that offers advanced imaging technology for surveillance applications.

“It (space) is an amazing market. Space industry is exploding for a variety of reasons such as surveillance, Smart City applications, Internet access, and defense areas,” Viswanathan said, adding that a lot of opportunities are likely to come into play, and the US fund is bullish on India’s potential in this nascent sector.

The policy framework inclined to ease of doing business, according to him, eventually make it easier for the capital to flow.

The VC firm also invests in semiconductor technology, and said that the semiconductor segment requires acceleration in the pace of innovation, and the semiconductor manufacturing which concentrated heavily in Taiwan may take time to shift to any other country.

“Large companies that are dependent on Taiwan to manufacture are not going to be able to switch sides. India needs to set up infrastructure, technology manufacturing capability and develop the ecosystem,” he added.

India, according to him, has to figure out what are the pockets of innovation in the semiconductor industry that are low-hanging fruits as it aspires to build a leading edge fab. “Taiwan already has a 3-nanometer (nm) fab. If India were to try to build a 3-nm fab as the first thing that would be a mistake.”

In December last year, the Centre unveiled the ambitious India Semiconductor Mission (ISM) that aims to formulate a comprehensive long-term strategy for developing sustainable semiconductors, design ecosystem, and display manufacturing units in the country.

“In fabless companies, there are really no constraints. If you (India) can provide the right incentives for companies to get funding, you will see a lot of fabulous companies get created, which is fantastic. Because once that happens, there will be an ecosystem developed around that, which will lead to the need for domestic manufacturing of semiconductor fab,” he added.

India is eyeing to become a preferred destination for semiconductor industry in line with Atmanirbhar (self reliance) ambition following supply chain disruptions amid Covid-19 induced shutdowns.

Prime Minister Narendra Modi-led government also aims to facilitate a multi-fold growth of Indian semiconductor design, foundry services, and other suitable mechanisms for early-stage startups.

Recently, US-based chipset giant Qualcomm said that it might outsource manufacture of semiconductor chips to India once the country sets up its own fab plants and Outsourced semiconductor assembly and Test (OSAT) facilities.

Micron Technology is setting up its testing and assembly plant in Gujarat’s Sanand at a proposed investment of $2.75 billion. Advanced Micro Devices (AMD), a chip design company, is investing up to $400 million in India over the next five years.