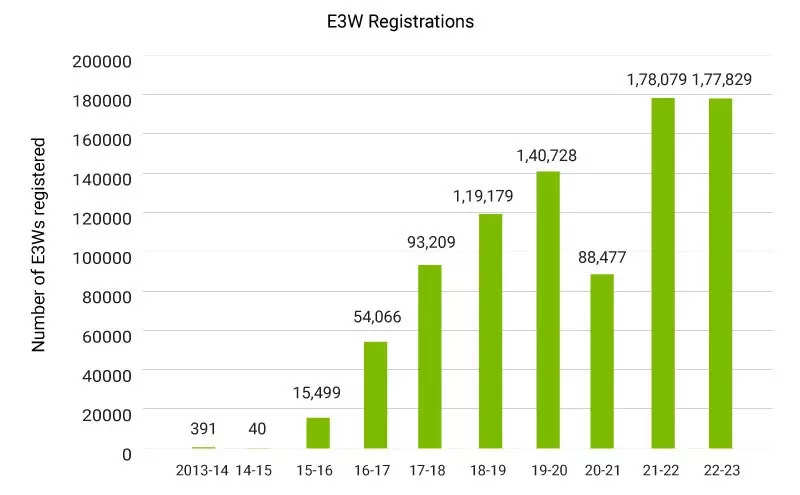

New Delhi: Three-wheelers (3Ws) play a vital role in last-mile connectivity. Electrifying them is crucial for eco-friendly transportation. As per September 2022 Vehicle Retail Data by the Federation of Automobile Dealers Associations, the 3W segment is shifting from internal combustion engine (ICE) vehicles to electric vehicles (EVs), with a notable rise in e-rickshaws. In India’s EV market, electric three-wheelers (E3Ws) hold significant market share: 59.4% for the passenger segment and an additional 4% for the cargo segment (JMK Research & Analytics 2022).The figure below illustrates the E3W registration trends in India from 2013-14 to 2022-23.

Registrations witnessed consistent growth from 2015-16 to 2019-20. However, there was a significant decline in E3W registrations in 2020-21 due to the impact of the COVID-19 pandemic on the Indian economy across various sectors. Nevertheless, recent years have seen a recovery, with registrations doubling from 88,477 in 2020-21 to 1,78,079 in 2021-22.

AEEE, ICA survey

However, 3W electrification is facing various financial, operational, manufacturing, and safety-related challenges such as manufacturing concerns, financial challenges, the battery swapping ecosystem, and state policies’ role in E3W adoption. In order to increase adoption of E3Ws in India, the Alliance for an Energy Efficient Economy (AEEE) in association with International Copper Association, conducted a research study and stakeholder consultation on, ‘Catalysing the Market Transformation of Electric 3-Wheelers in India’. This study examines the perspectives of consumers and different stakeholders involved in the E3W ecosystem – fleet operators, financial institutions, dealerships, and service centres. The study was carried out in three cities – Delhi, Lucknow, and Bangalore, with the majority of the survey (70%) conducted in Delhi.

Insights from stakeholder consultation

Retrofitting of conventional three-wheelers to the electric drive train

Retrofitted EVs use almost the entire body frame of the original vehicles. They offer the same economic and environmental benefits as new EVs of comparable specifications while allowing for the reuse of body parts and materials that would otherwise be disposed of. This helps reduce both the cost of purchasing a new electric car and the amount of scrap created by existing vehicles. Furthermore, retrofitting existing vehicles helps maintain the traffic on road by reducing the influx of new (electric) vehicles on the road without additional measures to replace the older (ICE) vehicles.

FAME II does not offer incentives on retrofitted vehicles, but many state EV policies support such retrofits. For example, Telangana’s EV policy includes a 15% subsidy, or INR 15,000, for the first 3,000 retrofits of passenger E3Ws. Subsidies for retrofitting 3Ws also need to be provided from the central government so as to make this shift easier. Currently, the cost of a retrofitting kit is INR 1.8-2.2 lakhs for fixed batteries.

Manufacturing of electric three-wheelers

Interventions in key areas such as R&D for EV technologies, battery life enhancement, interoperability, component manufacturing, certification procedures, safety standards, and standardization are essential for E3Ws. To ensure safety and standardization, thermal propagation test requirements should be established, while manufacturers should provide charge and discharge cell data. Tailoring cell selection to Indian conditions is crucial, but the country’s heavy dependence on raw material imports poses a challenge. Additionally, an effective Battery Management System (BMS) is necessary for accurate estimations of battery pack life and performance.

However, the implementation of interoperability remains a challenge as the industry is still in its early stages. The government should provide guiding principles or broad outlines rather than specific requirements for form factor or battery shape. Norms and standards should be industry-led to foster experimentation, evolution, and innovation without stifling investments in the sector.

Financing challenges for E3Ws

E3W financing is divided into two categories: 1. Individual financing, where last-mile connectivity players own the vehicle, and 2. Financing of fleet or government E3Ws used for purposes like cargo transportation and garbage collection, owned by contractors. Collaboration between original equipment manufacturers (OEMs) and financiers is crucial. Currently, financiers are uncertain about the investment potential due to a lack of performance track records. It is essential for OEMs to provide technologically detailed information, such as telematics, to financiers, which can enable tracking and reduce the risk of nonperforming assets (NPAs). Managing credit risk lies with the financiers, while product risk is the responsibility of the OEMs.

Major OEMs have established their finance subsidiaries, like Omega Seiki, to offer easier access to financing options. This model can incentivize consumers to purchase E3Ws. Financiers need to gain more awareness of EV technology, including telematics, which can aid in tracking and mitigate the risk of NPAs.

Battery swapping

Consumers have range anxiety and low confidence in switching to EVs due to long charging times. Battery swapping has the potential to eliminate this issue. However, every technology comes with its pros and cons. Mishandling of batteries due to lack of training leads to losses for the operators. There is a need to educate drivers on battery use and handling. In the case of damage, the company should be responsible since it is a (Battery-as-a-Service) BAAS model.

To enhance the adoption of E3Ws, two models should be implemented: 1. The BAAS model, which reduces the cost of E3W ownership through battery swapping, and 2. The Mobility-as-a-Service model, where vehicles are available for rental. NITI Aayog is expected to release a battery swapping policy that can be incorporated into state-level EV policies.

EV policies

The government has introduced several policies and plans to increase the pace of EV adoption among consumers. The central government has introduced schemes such as FAME I and FAME II that provide different types of financial incentives. There are two major relevant central policies. First, the government has allowed the sale of E3Ws without batteries, which can reduce their upfront cost and facilitate battery swapping. Second, there is a new voluntary vehicle scrappage policy and age limit to undergo a fitness test for a private vehicle is set at 15 years.

State-level policies encompass a range of measures such as E3W targets, purchase subsidies, tax exemptions, scrappage policies, interest subvention, free permits, designated green zones, reserved parking spots, capital subsidies for charging equipment, and battery swapping. These policies incentivize the adoption of E3Ws through subsidies for new vehicles and retrofitting incentives for existing ICE 3Ws.

States can also encourage retrofit kit manufacturers by offering incentives, promoting market competition, improving product quality, and driving down prices. Additionally, state EV policies should address battery recycling and reuse for a more comprehensive approach.

Key recommendations

The following recommendations are derived from the various parts of the study, including the E3W technology classification, consumer survey, review of national and state-level policies and schemes, and stakeholder consultations. The recommendations aim to address the barriers to EV adoption in India, particularly in the E3W segment.

Government:

• Installation of more PCS and regular health check of PCS, as 65% of the drivers faced issues related to non-functional charging points and long waiting times

• Provide investment support to charging and swapping players, especially to start-ups, as this would help accelerate the rollout of charging stations

• Regular EV awareness forums to make people aware of EV-related benefits & incentives

Vehicle OEMs:

• Provide better training to service centre technicians, as this would help reduce the servicing time.

• Improve build quality by seeking regular customer feedback, as 45% of the drivers stated that the build quality is better in ICE 3WS

• Partner with major financial institutions to provide cheaper loans, as the average ROI & down payment are greater than for ICE 3Ws

Charging/swapping players:

• Make charging/swapping applications robust & user-friendly

• Replace old batteries at swapping centres with new ones, as the average range for swappable batteries is only 70 km

• Adoption of a single charging application, as 91.4% of drivers stated that there should be a single application with access to all PCS

(Disclaimer: Dr. Vikas Nimesh is Senior Research Associate, and Anmol Jain is Research Associate at E-mobility, Alliance for an Energy Efficient Economy (AEEE). Views are personal.)