When talking about Electric vehicles, we can meaningfully agree that availability of well distributed and easy to access charging networks will be a vital factor for faster adoption of e Mobility.

When talking about Electric vehicles, we can meaningfully agree that availability of well distributed and easy to access charging networks will be a vital factor for faster adoption of e Mobility.

Charging networks need to provide fast, reliable, and sustainable charging to help enable seamless travel while assuaging range anxiety concerns.

A quick look at how the global market situation is evolving in this context will certainly help glean insights into how charging ecosystems are developing across the world.

NORTH AMERICA

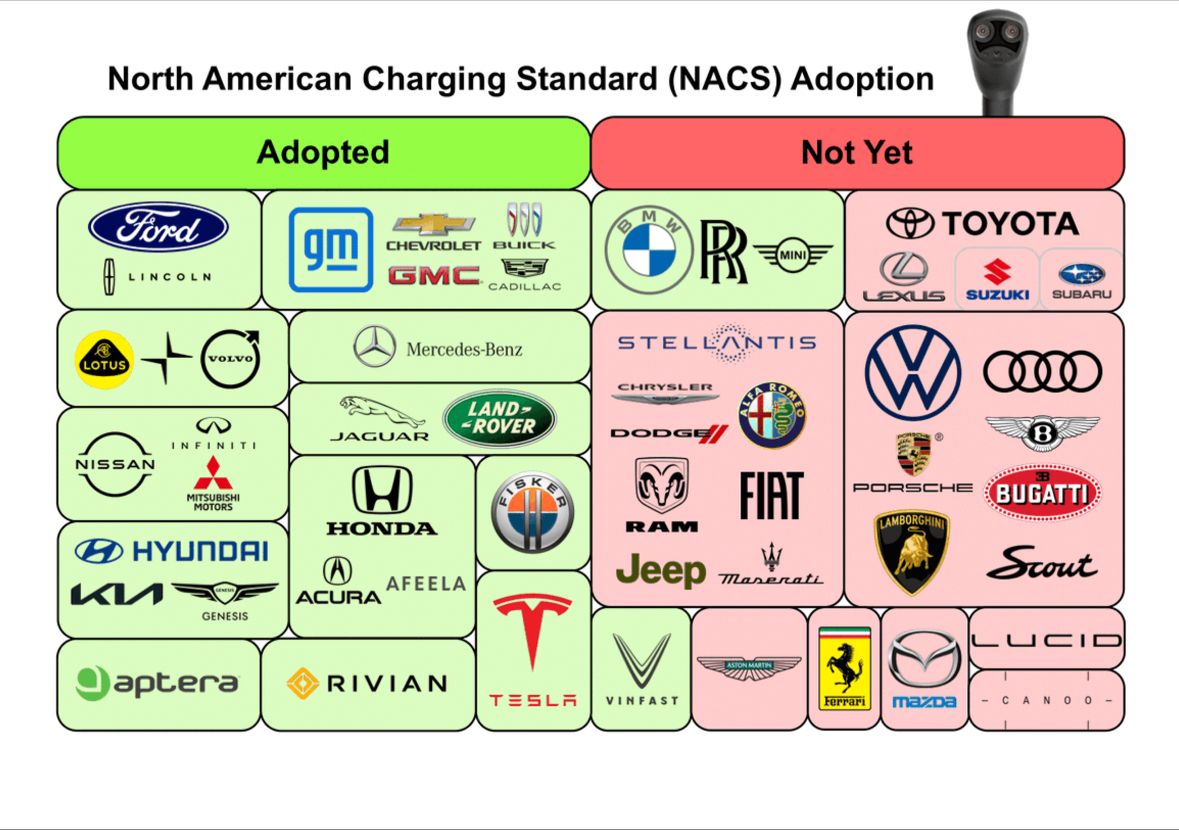

In October 2022, Tesla started reaching out to non-Tesla owners by releasing a Level 2 home charger that works with non-Tesla vehicles. Soon after (Nov 2022), Tesla launched an initiative to make its NACS (North American Charging Standard) port, the national EV Charging standard, published its manufacturing specifications, and openly invited competing automakers to adopt NACS standard, however, no other OEM responded.

Parallelly, Tesla was in discussions with specific OEM’s, and in May’2023, Ford announced that starting in 2024 Ford EV customers will be able to access Tesla Superchargers across US and Canada. Soon after, Marry Barra, CEO of General Motors also announced that GM will make Tesla NACS open-source connector standard in all GM EVs from 2025.

Existing Ford and GM EV owners do not need to upgrade their vehicles to use Tesla’s chargers and can utilize an adapter to make their vehicles compatible with Tesla Superchargers. Additionally, GM also plans on developing an adapter that will allow future NACS-enabled EVs to charge at its existing network of CSS-capable fast charging stations.

Close behind Ford & GM, other OEMs like Honda, Rivian, Volvo, Polestar, Nissan, Mercedes-Benz, Jaguar, Hyundai, KIA, and Fisker have announced their intention to apply standardized Tesla NACS connectors on their future cars, however, implementation timelines for some of these OEM’s are yet to be clearly defined.

What motivates Tesla to open access to its Supercharger network, a clear differentiator, to its competitors is a compelling question. Well for one, open access to its Supercharger network allows Tesla to access a share of $ 7.5 billion in Federal funding for charging infrastructure. With states like Texas and Washington approving initiatives mandating charging stations to be equipped with Tesla’s NACS connector to get access to over $400 million in subsidies.

There could be a concern from the point of view of existing Tesla owners so far habituated to easy anytime access to the Supercharger network, and how they would feel on finding all charging equipment at a Tesla Supercharger station being used by Non-Tesla owners.

Tesla believes that more customers using the Supercharger network will enable faster adoption and expansion of e Mobility. Its ambition to open Tesla Supercharger network to non-Tesla EVs is intended to boost the overall availability of charging locations and encourage more drivers to opt for an electric vehicle, with Federal funding of course an added bonus.

So how does Tesla plan to facilitate access to its Supercharger network by non-Tesla owners. For this, Tesla has retrofitted a “Magic Dock,” an adapter that automatically attaches to allow other brands access its charging facilities. Non-Tesla owners need to access the Tesla app, create an account, and select Charge your Non-Tesla option.

The immediate on ground challenge that non-Tesla owners currently face is that Tesla Supercharger parking slots have been designed only with Tesla vehicles in mind that have their charging socket located in the same spot on the back left corner of the car posing a challenge for EVs that have their charging ports located at a different point on the vehicle (The cable length of the Supercharger is a constraint)

Charging Network Joint Venture

In a separate development, BMW Group, General Motors, Honda, Hyundai, Kia, Mercedes-Benz Group, and Stellantis NV, (brands collectively representing close to 50% vehicle sales) have announced a joint venture to create a vehicle recharging network across North America and significantly expand access to high powered charging while gaining advantage of the subsidy program.

The alliance targets to install at least 30,000 charge points in urban and highway locations accessible to nearly any EV by offering Combined Charging System (CCS) and North American Charging Standard (NACS) connectors.

In addition to being part of the alliance, in early Jan’2023, Mercedes-Benz announced its intention to build its own high power charging network covering North America, Europe, China and other key markets.

Mercedes-Benz targets installing more than 10,000 ultra-rapid chargers worldwide by 2030 which is aligned with the timeline by when the company wants to be fully electric “where market conditions permit”.

Trucks

Pilot Company and Volvo Group have agreed to develop a high-performance charging network open to all battery-electric Class 8 truck brands to support fleet customers in their electrification and decarbonization journey.

EV Charging Platform

In addition to expanding charging footprint, BMW, American Honda, and Ford have taken a broader view of the charging ecosystem and are creating a single platform called Charge Scape connecting electric utilities, automakers, and EV customers to help improve support grid resiliency and support V2G capabilities.

Charge Scape’s platform will give electric utilities access to EV battery energy across a pool of EVs. Participating customers will potentially earn financial benefits by charging at “grid-friendly” times through flexible and managed schedules. EV users will also have opportunity to share energy stored in their EV batteries with the grid during times of peak demand through vehicle-to-grid (V2G) applications.

EUROPE

Tesla started opening its Supercharger network (70% of their network in Europe) for non-Tesla electric vehicles in Europe in 2021 starting from the Netherlands, followed by Norway, France, Germany, Italy, Spain, Sweden, and UK.

Facilitating access to the Supercharger network in Europe was relatively easier since Tesla Superchargers use a CCS2 connector which is standard across Europe.

Ionity

While OEM alliances in Europe started in early 2017 with Ionity (BMW, Daimler, Ford, Volkswagen and Hyundai), the alliance has built a network of only about 2,600 chargers since 2017.

Daimler

While Daimler is a member of Ionity, its approach for its High power charging network is to set up charging hubs in major cities and metropolitan areas near main traffic arteries and retail and service locations, including its car dealerships.

While these hubs will prioritize Mercedes drivers, who will get preferential rates and access thanks to a reservation function, the charging parks will also be open to all other vehicle brands with compatible technology.

BMW Group

Separately, the BMW Group and E.ON have agreed on the first pan-European cooperation for intelligent charging at home. The cooperation will focus on at-home charging and create a holistic charging ecosystem allowing customers to connect their BMW or MINI with the energy system.

The cooperation aims to create “Connected Home Charging”, a holistic charging ecosystem by creating a common interface combining BMW Group electric vehicles, customers’ smart homes, and the energy market.

While BMW will be responsible for the vehicles and charging hardware and managing customer interface, E.ON will take care of providing installation, electrical, and connectivity services at customers’ homes and ensuring sustainable energy tariffs and access to the energy market, which plays a key role in the intelligent control of charging processes.

Volkswagen Group

Volkswagen Group has created a new automotive energy and charging division called Elli (short for Electric Life) that aims at providing carbon neutral power across diverse charging network with access to more than 550,000 public charging points across Europe. Elli’s goal is the digital networking of energy and mobility driven by its conviction that e-mobility can be sustainable, only if vehicles are powered by electricity generated on a CO2-free basis. The group aims to source renewable power from Wind, Solar and Hydropower facilities in Germany, Austria and Switzerland.

In July 2023, Volkswagen became the first automotive company to be listed on the German electricity market (EPEX Spot Power Exchange). The basis for electricity trading is their stationary storage system made of e-up! batteries and a new, digital electricity trading platform. In the future, the stationary storage system – called “PowerCenter” – will store energy traded on the electricity market. Volkswagen and Elli aim to harness the growing storage capacities of electric cars and batteries in future with the Power Centre system and make an important contribution to energy transition.

In Sep 2023, at the IAA mobility show in Germany (Munich), Elli showcased its Flexpole fast charging station connected to an integrated battery energy storage so that the installation does not require special transformers or costly constructions; it connects to the low-voltage grid instead and still delivers up to 150 kWh to charge a car. Shell and Volkswagen plan on gradually rolling out Flexpoles in Germany and other European countries.

Renault Nissan Alliance

Renault Group with its most diversified line up of Electric vehicles in Europe and Nissan are considering jointly deploying charging infrastructure in Europe. Rival European automaker Peugeot has Peugeot has partnered with Octopus Energy offering access to over 400,000 public charge points across the UK and Europe.

Shell Recharge Network

In April 2023, BYD partnered with Shell Recharge network in Europe to offer preferential access to Shell Recharge network as part of its mobility service provider (MSP) partnership with Shell. BYD customers will receive an exclusive Shell Recharge network platinum membership that offers discounted charging at Shell’s fast and ultra-fast DC charging locations.

Shell Recharge will offer BYD customers access to over 300,000 charge points across Europe through Shell’s growing network of charge points at Shell stations, mobility hubs, destination, and on-street locations and one of Europe’s largest roaming networks.

Milence

Truck companies Volvo Group, Daimler Truck and Traton

Group (Scania, MAN) has formed a joint venture for charging infrastructure in Europe called Milence that aims to build high capacity public charging points in Europe to help accelerate the transition to zero-emission heavy-duty vehicles.

Fit for 55

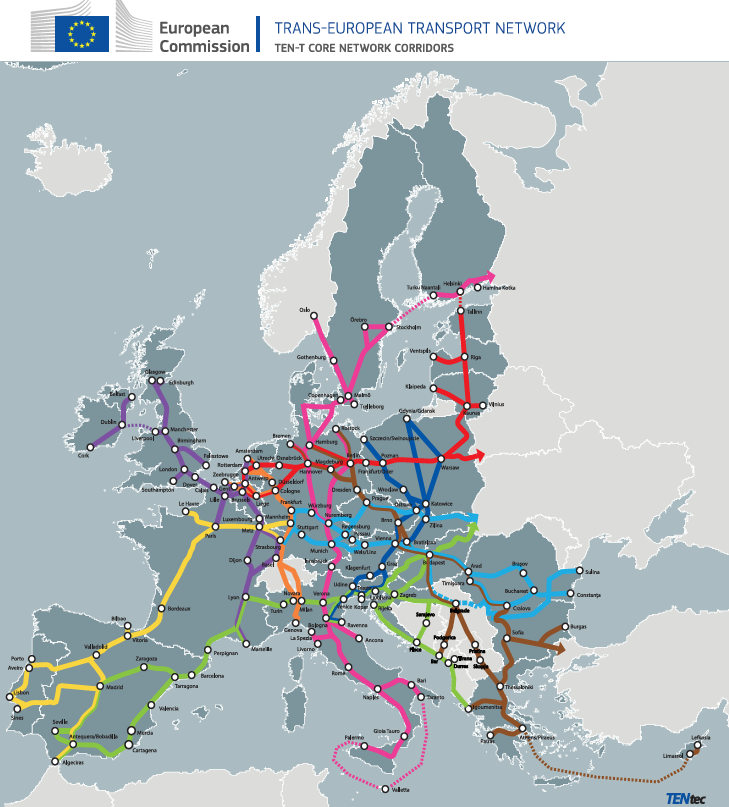

In March 2023, the EU agreed on its landmark regulation on EV charging – the Alternative Fuels Infrastructure Regulation, or AFIR, that lays down foundation for building a comprehensive network of EV charging stations across major European roads.

In July 2023, the European parliament approved new rules as part of its “Fit for 55” package intended to reduce emissions by 55% by 2030. These regulations focus on expanding access to fast EV charging networks by mandating minimum speeds and distances between charging stations.

Under the agreement, charging stations for electric cars will be placed every 60 km along the EU’s main highways by 2026. Higher-powered chargers for trucks and buses must be rolled out on at least half of the EU’s core network every 120 km by 2028, while hydrogen refueling stations will be installed at least every 200 km by 2031.

The rules cover Europe’s “TEN-T core network,” the main arterial road networks that cover all of Europe.

CHINA

With the largest EV network in the world, China is definitely a very important market when it comes to charging.

Synchronous with what it is doing globally, Tesla in April 2023, opened 10 Supercharger stations in Beijing and Shanghai for 37 different electric vehicle models. Like Europe, in China, Tesla uses the Chinese standard connector, facilitating easier open access.

In mainland China, around 37 models will be able to use Tesla’s chargers, including vehicles from Aiways, BMW, Porsche, BYD, Dongfeng, Ford, Geely, Zeekr, Polestar, Nio, Volvo, XPeng, and more.

BYD and Shell JV

In March 2022, BYD the world’s largest new energy vehicle maker, and Shell signed a strategic cooperation agreement to help accelerate the energy transition and improve charging experiences for EV customers. The partnership will start in China and Europe and will extend to other regions across the globe.

In China, the joint venture currently operates more than 13,000 charge points in Shenzhen. As part of the partnership, BYD and Shell have also opened the world’s largest EV charging station in Shenzhen, China with 258 DC fast charging points.

China’s largest EV vehicle charging station company, Teld New Energy (parent company T Good Electric) has partnered with more than 70 automakers, including BYD, BMW, Audi China, NIO, and XPeng, in a variety of areas, including charging rights and the establishment of branded stations.

Interestingly, the second largest player is State Grid Corporation of China (SGCC) which is a state-owned Electric Utility Corporation. The third largest player, Star Charge has formed strategic partnership with almost 60 Auto OEMs worldwide which include Mercedes-Benz, Porsche, BMW, Jaguar Land Rover, and Volkswagen as international OEMs, BYD and BAIC as domestic OEMs.

JAPAN

Japanese automakers Toyota, Nissan, Honda, and Mitsubishi together with Development Bank of Japan and Energy companies Tepco and Chubu had jointly formed a company called Nippon Charge Service in 2014. In 2021, e Mobility Power Co entered into an absorption type company split agreement with Nippon Charge Service and will continue work on the partnership moving forward.

European makers, Porsche and Audi are building a premium charging alliance business partnership in Japan to expand its 150 Kw charging network.

Suzuki Motor Corporation has signed an MoU with the Tokyo-based PowerX Inc, which manufactures and sells battery energy storage systems, to start exploring business partnership opportunities for battery energy storage systems ad EV chargers in Japan and India.

Japanese leasing company Orix in partnership with Ubiden (funded by Soft Bank) plans to install 50,000 charging stations by 2025 which is likely to represent close to 1/3rd of Japan’s total charging network.

Swappable Battery Motorcycle Consortium (SBMC)

In 2019, the Japanese Big Four — Honda, Yamaha, Suzuki, and Kawasaki — formed a swappable battery consortium. While the consortium did not make significant progress, in 2021 a second consortium consisting of Honda, Yamaha, KTM, and Piaggio was formed.

This consortium is called the SBMC (Swappable Battery Motorcycle Consortium) and it rolled out its first demonstration of a co-designed battery standard, with a battery that Honda developed for its Electric scooter.

The consortium has rapidly grown and SMBC members now comprise of companies like AVL, Ampace, Ciklo, CFMoto, Dellorto, FIVE, Forsee Power, Greenway, Hioki, Honda, Hyba, Infineon, Kawasaki, KTM, KYMCO, Keeway, LG, Mitsuba, Niu, Piaggio, Polaris, Quantum Volts, Roki, Samsung, Sinbon, SMobery, Sumitomo Electric, Suzuki, Swobbee, Segway-Ninebot, Triumph, Vitesco, VeNetWork, Voltaira and Yamaha.

Interestingly, member companies are both manufacturers of two-wheeled electric vehicles as well as technology companies that can benefit from a single standardized energy pack.

INDIA

The EV conversation in India largely revolves around e2W and e3W that are championing e Mobility adoption in India.

Electric Two Wheeler

On the e2W front, both Ola and Ather have rolled out has begun rolling out their proprietary chargers at major BPCL pumps as well as residential and commercial complexes across cities.

Interestingly, while Ola Hyperchargers are designed for charging Ola scooters only and are free to use for a limited period, Ather Grid’s chargers are compatible with electric vehicles that use a 5A charger, making it easy to charge your scooter no matter what type of vehicle you have. The service which was free of charge earlier has changed to a fee based charging model from 1st August’2023 with charge of Rs 1/min plus GST being levied.

Swappable Battery Motorcycle Consortium (SBMC)

Meanwhile members companies of SBMC, Honda is presently testing swappable battery tech for India using its Benly e electric scooter. Honda has also teamed up with HPCL to set up battery-swapping stations across the country.

Similarly, Yamaha and Piaggio are presently developing electric scooters for India. The fourth lead partner KTM in collaboration with Bajaj is planning premium electric offerings based on both scooter and a motorcycle platforms

Bharat Charge Alliance

Bharat Charge Alliance, an alliance led by Bharat Forge backed start up Tork Motors aims to democratize low voltage EV charging for 2 and 3-wheelers that only allows for DC charging.

It is believed that companies like Greaves Electric Mobility, Vayve, MTA, Ador, Exicom, EVQ Point, Solterra, Charge Zone, Coulomb EV have expressed interest in the alliance however no formal understanding is in place.

The alliance believes that it can be challenging for any common charging standard/protocol to succeed unless the alliance members from a critical mass/share of the market and requires Alliance partners to have a common standard for plugs, connectors, and charging protocol

Electric Three Wheeler

Electric 3 wheeler maker Mahindra Last Mile Mobility is setting up charging stations at public areas, Mahindra outlets and Mahindra Mitra Technician locations. Omega Seiki Mobility is launching EV charging network under the same OSM e Link which will be open to access by other EV’s as well. Piaggio has opted for Swappable batteries supported by the Sub mobility network.

Electric Four Wheeler

Jio-BP has partnered with brands like TVS, Hero Electric, MG, Mahindra, Citreon, and ride hailing companies like Uber, Blusmart along with real estate developers to expand the charging footprint, Additionally, Jio BP Pulse is engaged in setting up battery swapping stations for last mile delivery for brands like Zomato, Swiggy etc.

Tata Power has partnered with Tata Motors, JLR, MG, and Hyundai to provide charging infrastructure. Chargers installed at the dealerships of these OEM’s will be open to the entire universe of EV car customers to help boost EV adoption among consumers. Hyundai India has also established manned fast charging stations open for all EV owners along key highway routes in India.

Battery Swapping

Sun Mobility a leading player in the Battery swapping segment, utilizes interoperable Batteries and has partnerships with brands like Piaggio, Ashok Leyland, Greaves Electric Mobility, Terra Motors, Omega Seiki, Amazon, Zypp and Zyngo. Sun Mobility has recently unveiled a compact and portable battery-swapping solution requiring minimal power and real estate.

Battery Smart another prominent player in the Swapping segment, collaborates with local businesses to set up stations and is mainly

targeting low-speed e-rickshaws, ‘L3’ electric vehicle category along with low/mid speed e2W mainly deployed by last-mile e-commerce delivery and logistics players.

RACEnergy another company in the Swappable space has in addition to Battery Swapping also developed retrofit kits that convert existing ICE autorickshaws into electric vehicles compatible with its swapping network.

Bounce Infinity another company actively focusing on Battery swapping is setting up Swap stations at BPCL filling stations initially starting with Bangalore. Bounce Infinity also has a strategic partnership with Greaves Retail to provide battery-swapping stations for Greaves-owned Ampere scooters.

International Swapping player Gogoro in partnership with Zypp Electric that offers EV as a Service and is at pilot stage for Battery Swapping and Smart Scooters for Last Mile Delivery.

Interestingly, Finnish State owned energy company, Glida (earlier known as Fortum) has partnered with Charge+Zone, to provide EV users access to larger EV charging networks of two companies,”

Conclusion

The race for establishing EV charging infrastructure has begun with very different inferences from across the globe. Attitudes toward sustainability are maturing and IT IS expected that OEMs will lead the way to sustainable change.

The US clearly favoring a collaborative effort amongst OEMs, Europe witnessing an interesting blend of collaboration, OEM level initiative, and partnership with Oil and gas companies actively diversifying into charging infrastructure.

China has EV charging companies taking lead in forming strategic partnerships with OEM’s as well as OEM level partnership with Oil and Gas companies and finally Japan with an interesting combination of OEM collaborations along with leasing companies expanding into a new business area.

A clear pattern in India is still to emerge with proprietary charging network owners like Ather opening access of its charging network to its competitors, charging and battery swapping operators forming multiple OEM partnerships, and also OEM alliance specifically in the e2W segment.

Two questions that we will continue to find answers for are the possibility of OEM collaboration especially in the e4W and Truck segment in India (and who will take lead) and how opening of Tesla charging network to competition in the rest of the world will add a completely new business dimension of data monetization to Tesla existing business based on competitor data that they will collect through the network.